Opportunity Zones & Funds for Developers and Investors

Wednesday, June 13, 2018

Tax Cuts and Jobs Act of 2017 "Tax Cuts Act"

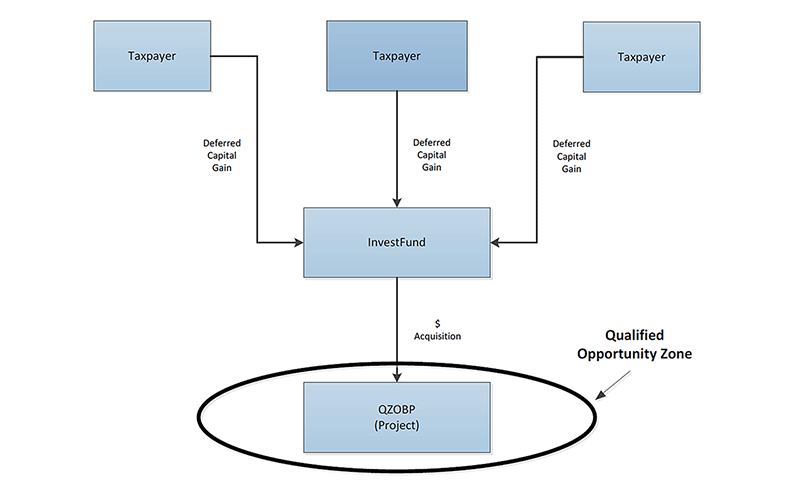

- New Incentive for reinvesting Capital Gains and deferring taxes

- Requires "Fund" investment to be in Qualified Opportunity Zones

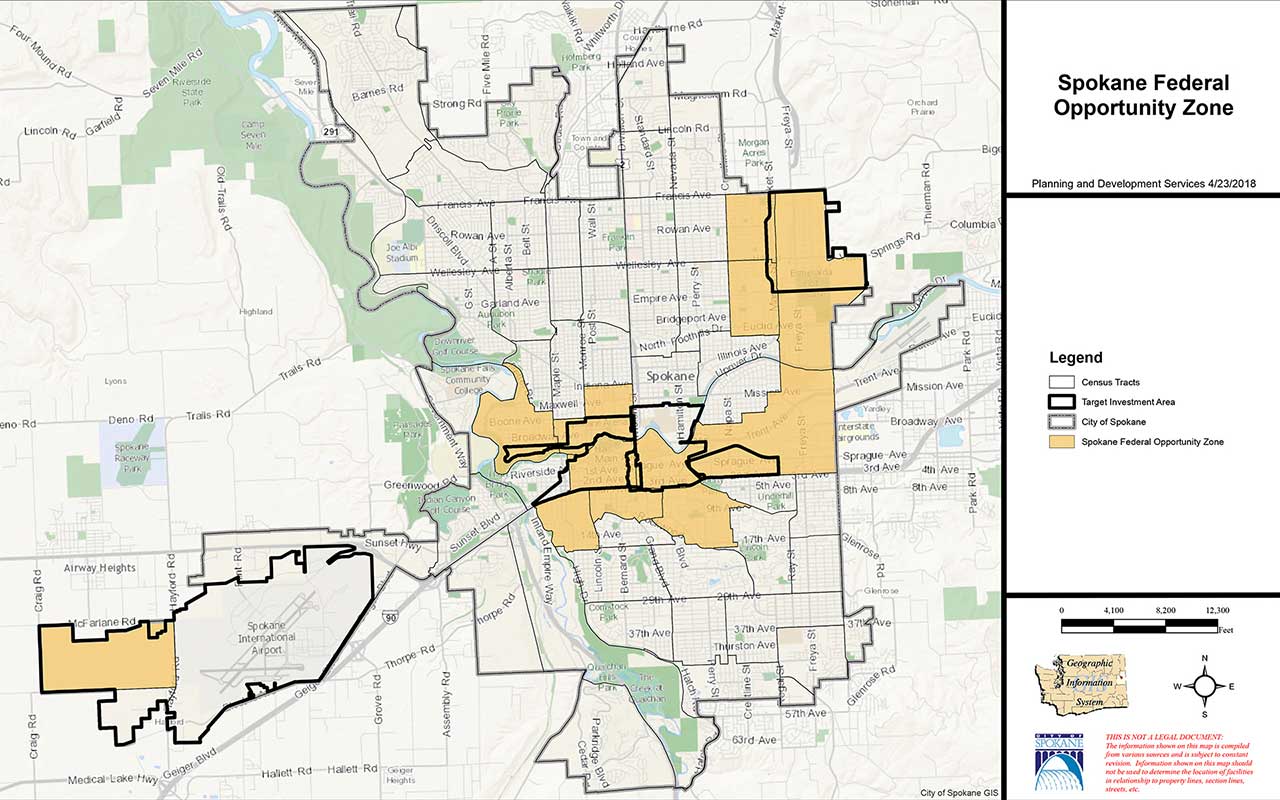

- Treasury Qualified 11 tracts in Spokane to accept investment "Funds"

- Treasury is still completing the rules for the "Funds"

- What we do know about the "Funds"

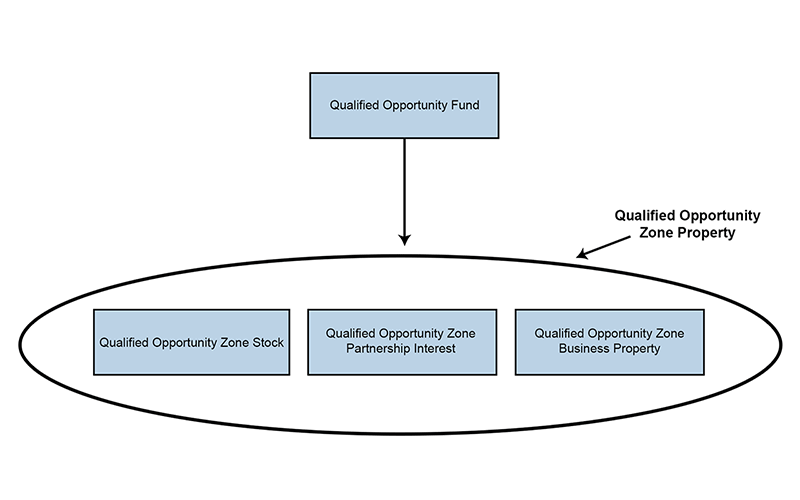

- Can be a Partnership or Corporation set up to invest in QOZ property and they will self-certify with IRS

- You can get the tax benefits, even if you don't live, work or have a business in an Opportunity Zone

- If the investment is held for less than 5 years as of Dec. 31, 2026: All of the deferred gain is recognized as of 12/31/2026. If the investment is sold or exchanged after 12/31/2026 for FMV (after being held for at least 10 years) the taxpayer recognizes no additional gain, due to the FMV basis election, even if the investment has increased in value between 12/31/2026 and the date of disposition.

- If the investment is held for at least 5 years by Dec. 31, 2026: 10% basis adjustment applies; 90% of deferred gain is recognized as of 12/31/2026. If the investment is sold or exchanged after 12/31/2026 for FMV (after being held for at least 10 years) the taxpayer recognizes no additional gain, due to the FMV basis election, even if the investment has increased in value between 12/31/2026 and the date of disposition.

- If the investment is held for at least 7 years by Dec. 31, 2026: 15% basis adjustment applies; 85% of deferred gain is recognized as of 12/31/2026. If the investment is sold or exchanged after 12/31/2026 for FMV (after being held for at least 10 years) the taxpayer recognizes no additional gain, due to the FMV basis election, even if the investment has increased in value between 12/31/2026 and the date of disposition.

-

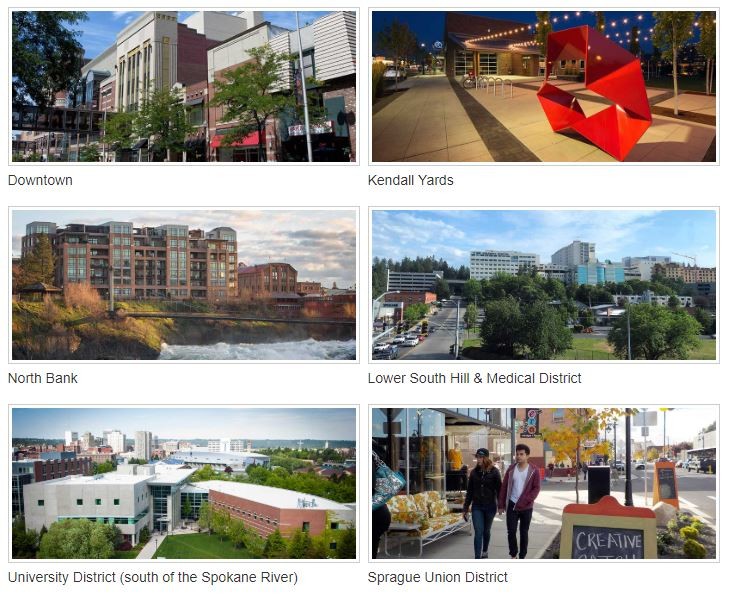

Downtown

-

Kendall Yards

-

North Bank

-

Lower South Hill & Medical District

-

University District (south of the Spokane River)

-

Sprague Union District

-

The Yard & Market St. Area

-

Portion of West Plains and International Airport

Why these areas?

- Economically distressed residents

- Attracting investment

- Targeted Investment Areas

- Aligned with other incentive areas

- Partners in place Public Development Authorities and Business Improvement Districts

- Pipeline projects ready go

- Opportunities for new investment

Alignment with Strategic Plan

- Grow targeted areas - Invest in key neighborhoods and business centers; especially PDA's

- Marketing Spokane – Market Spokane's urban advantages and experiences to grow jobs and economic development

- Public amenities - Invest in key public amenities and facilities

- Regional collaboration – work collaboratively with regional partners